WATCH OUR 2020 VISION

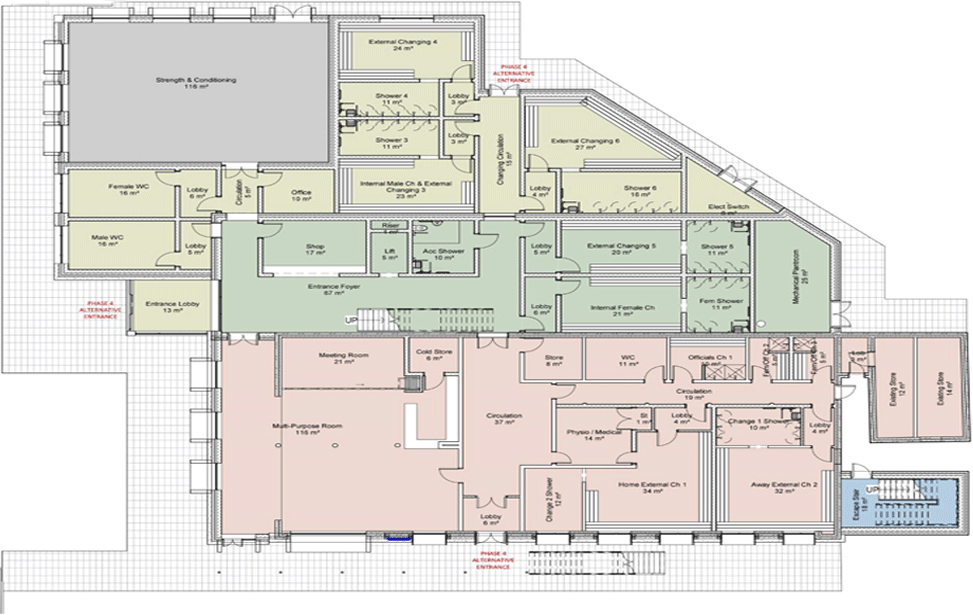

Following many hours work by volunteers, in October 2018, we achieved planning permission for the extension and refurbishment of our clubhouse to meet the demands from our increasing male and female playing numbers.

Work has now been completed on Phase One of our Clubhouse Development, the foundations have been laid, the new changing rooms area is built and a lift has been added to a new stairwell construction, to aid access within the Clubhouse for those with disabilities.

This is fantastic news and a significant milestone has been reached.

Read More Donate Now Donate By Instalments

READ MORE ABOUT OUR 2020 VISION AND HOW TO DONATE

Total raised so far

£196,000.00Target

£500,000.00Total to Hit Target: £304,000.00

2020 Vision Principal Aim

To raise £500,000 to fund, firstly, the completion of Phase 1 of the building development, costing approximately £440,000.

The Club have already raised over £200,000 plus council grants and other small grants totalling over £110,000. This leaves a shortfall of £150,000. This will be met by 2020 Vision.

2020 Vision Match Funding

Secondly 2020 Vision will raise “match funding” targeted at forthcoming large capital grants.

By raising an additional £350,000 will put our Club in a very strong position to attract large Sport NI or Big Lottery match funding grants.

2020 Vision Recognition of Donations

The names of all contributors will be inscribed on a 'Commemorative Board'.

This 'Commemorative Board' will be will be located, pride of place, in a prominent position in the newly renovated City of Armagh RFC Clubhouse.

We are asking for donations of at least £250 for our 2020 Vision club development appeal.

As we continue on our journey, we ask all members, players, supporters and friends of City of Armagh RFC to support the Club's ongoing fundraising efforts and 2020 Vision. This is your opportunity to make a massive difference to the future of City of Armagh Rugby Club.

Gift Aid

Every donation you make to City of Armagh RFC, whatever its value, could be worth more at no extra cost to you, just by choosing to Gift Aid it. Boost your donation by an extra 25p for every £1 you donate to City of Armagh RFC with Git Aid.

Firstly, the Club will benefit by claiming Gift Aid tax rebates from HMRC. Secondly, any ‘higher rate’ taxpayers will be eligible to claim back tax rebates, for themselves, on their donations.

In order to Gift Aid your donation please ensure you select the Gift Aid option when making your donation. Please see Gift Aid terms and conditions below.1

Donate To Our 2020 Vision - One off payment or monthly instalment donation plans welcomed

Donation options include, a single one off payment donation or monthly instalment donation plans. To donate online simply click on one of the 'Donate Now' button options below. You will then be transferred to our Paypal site which will allow you to donate securely. Please note, you do not need a PayPal account to donate, you can pay as a PayPal Guest, using a Debit or Credit Card.

If you would like to donate another amount, or set-up an additional monthly payment plan, or have any queries, please contact our Club President, James Scott on T: 07720 537909 or via e-mail

* Please note that we aim to contact you, to thank you for your donation, via email or phone.2

DONATE TO CITY OF ARMAGH RFC 2020 VISION

Click here if you would prefer to donate via monthly instalment Donate By Instalments

One BlockCity of Armagh RFC 2020 Vision

£250Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Two BlocksCity of Armagh RFC 2020 Vision

£500Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Three BlocksCity of Armagh RFC 2020 Vision

£750Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Four BlocksCity of Armagh RFC 2020 Vision

£1,000Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Six BlocksCity of Armagh RFC 2020 Vision

£1,500Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Eight BlocksCity of Armagh RFC 2020 Vision

£2,000Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Ten BlocksCity of Armagh RFC 2020 Vision

£2,500Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Twelve BlocksCity of Armagh RFC 2020 Vision

£3,000Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Twenty BlocksCity of Armagh RFC 2020 Vision

£5,000Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Forty BlocksCity of Armagh RFC 2020 Vision

£10,000Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Sixty BlocksCity of Armagh RFC 2020 Vision

£15,000Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Eighty BlocksCity of Armagh RFC 2020 Vision

£20,000Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Pay Monthly One BlockCity of Armagh RFC 2020 Vision

£250£25 per month, over 10 months

Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Pay Monthly Two BlocksCity of Armagh RFC 2020 Vision

£500£50 per month, over 10 months

Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Pay Monthly Three BlocksCity of Armagh RFC 2020 Vision

£750£75 per month, over 10 months

Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

Pay Monthly Four BlocksCity of Armagh RFC 2020 Vision

£1,000£100 per month, over 10 months

Please Gift Aid your Donation

- Club House Redevelopment

- Enhanced Changing Facilities

- Enhanced Disabled Access

- Upgraded Medical Facilities

- Upgraded Parking Facilities

PayPal

Additionally, we are a VERIFIED PAYPAL MEMBER/SELLER. Keeping you safe online is one of our primary concerns. To that end, we've developed links with PayPal to help fortify your online security when you buy tickets for the Development Club Appeal. PayPal helps protect your credit card information with industry-leading security and fraud prevention systems.

When you use PayPal, your financial information is never shared with the merchant. When payment is confirmed we will contact you via e-mail and or phone, as well as sending you your Development Club Appeal tickets, by post, to your home address.

When you use PayPal, your financial information is never shared with the merchant. When payment is confirmed we will contact you via e-mail and or phone, as well as sending you your Development Club Appeal tickets, by post, to your home address.

1 Gift Aid Terms and Conditions

Every donation you make to City of Armagh RFC, whatever its value, could be worth more at no extra cost to you, just by choosing to Gift Aid it. Boost your donation by an extra 25p for every £1 you donate to City of Armagh RFC with Git Aid.

Firstly, the Club will benefit by claiming Gift Aid tax rebates from HMRC. Secondly, any ‘higher rate’ taxpayers will be eligible to claim back tax rebates, for themselves, on their donations.

Gift Aid is reclaimed by City of Armagh RFC from the tax you pay for the current tax year.

Your address is needed to identify you as a current UK taxpayer.

You are a UK taxpayer and understand that if you pay less Income Tax and/or Capital Gains Tax than the amount of Gift Aid claimed on all your donations in that tax year (from 6th April one year to 5th April the next) it is your responsibility to pay any difference. For advice on how to check if you’ve paid enough tax to use Gift aid, please visit the HMRC website.

Please let us know if you:

- want to cancel this declaration.

- change your name or home address.

- no longer pay sufficient tax on your income and/or capital gains.

If you pay Income Tax at the higher or additional rate and want to receive the additional tax relief due to you, you must include all your Gift Aid donations on your Self-Assessment tax return or ask HM Revenue and Customs to adjust your tax code. For more information on claiming back higher rate tax please visit the HMRC website.

2 Protecting your Personal Information:

We promise that any information you give us will be used by City of Armagh RFC only. You can change your contact preferences at any time by emailing info@cityofarmaghrfc.com

Club Adverts

-

Taranto

Visit Website -

Donnelly Group

Visit Website -

Cross Group

Visit Website -

Daikin

Visit Website -

Samurai

Visit Website -

Ulster Carpets

Visit Website -

Dalzells

Visit Website -

Johnston Advisors

Visit Website -

Noel Conn

Visit Website -

Lenco Utilities

Visit Website